Energy Challenge

Key Takeaway:

The explosive growth of generative AI is triggering a parallel surge in energy demand—forcing companies to rethink their energy strategies. Data center consumption is set to double by 2026, driving Big Tech to invest directly in nuclear, renewable, and distributed power sources. At the same time, AI is helping businesses optimize sustainability, from supply chain emissions tracking to energy efficiency. In Europe, clean energy innovation is accelerating, with virtual power plants and smart grids gaining traction. As energy becomes both a bottleneck and an enabler, companies must balance AI scale with climate commitments—where technology becomes both the challenge and the solution.

Trend Type: Technology

Sub-trends: (Re)New Energy, Nuclear Resurgence, Data Center of the Future, Sustain Vs Growth Challenge AI Era

The Collision of AI and Energy Demand

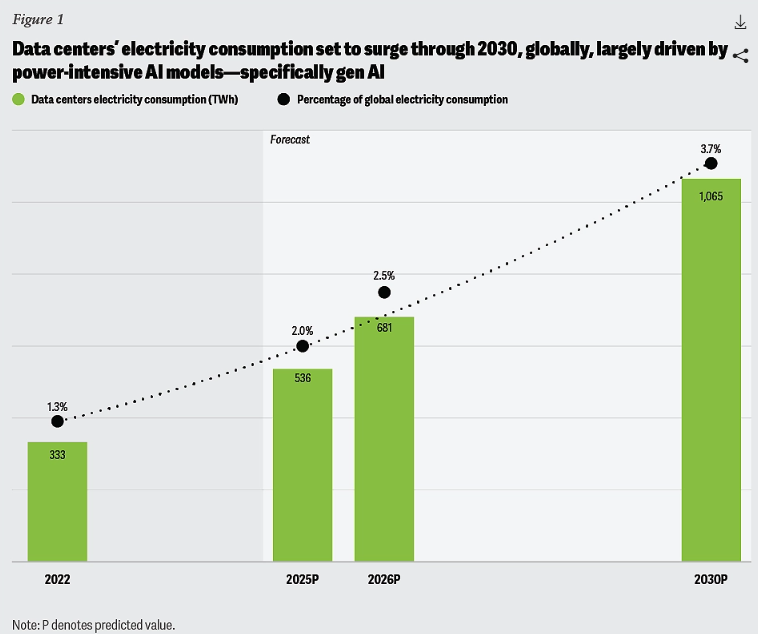

The rise of generative AI is not only transforming digital landscapes—it’s also reshaping the global energy equation. According to Deloitte, the rapid expansion of hyperscalers—large tech companies scaling up massive data centers to power AI—is forcing data centers to double their energy consumption by 2026, reaching over 1,000 TWh, equivalent to the total electricity usage of Japan. Forbes and PwC echo this urgency, with PwC warning that AI’s electricity demand will outpace supply, especially as energy-hungry large language models (LLMs) proliferate. This shift is prompting tech companies to evolve from energy consumers into energy strategists, exploring new infrastructure and direct investment in power generation.

Source: Deloitte Insights 2024 – Data Centers Energy Consumption

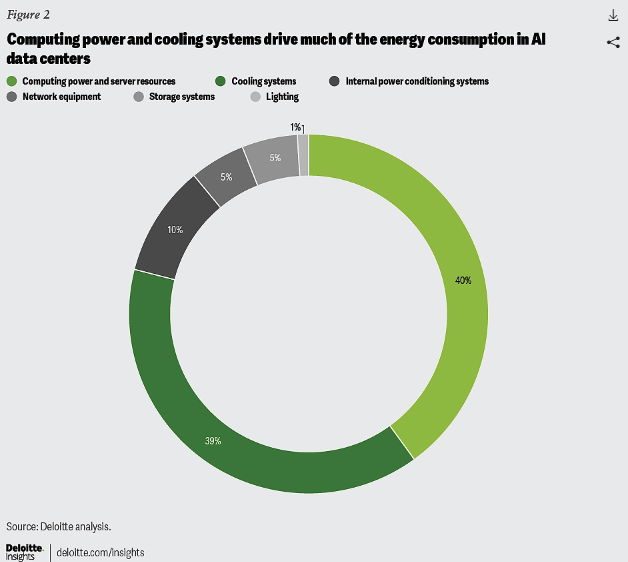

Big Tech is now a major driver of change in the power sector. Companies are moving beyond traditional utilities to explore nuclear, hydrogen, and renewable sources. Liquid cooling systems, smart processors, and software-defined energy networks are reshaping what a data center looks like. At the same time, Kyndryl notes that 75% of leaders struggle to keep up with this pace of technological change, and only a third feel prepared for the associated cybersecurity risks—a reminder that sustainability and resilience must go hand in hand.

Source: Deloitte Insights 2024 – AI Drivers of Energy Consumption

(Re)New Energy: From Grid Strain to Clean Innovation

PwC’s 2024 Cloud and AI Business Survey reports that 34% of companies increasing cloud budgets cite sustainability as a key driver. In Europe, investment in sustainability-focused companies is rebounding, with distributed energy resources (DER) like battery storage, solar panels, and virtual power plants gaining traction. Jorge Camacho of the Institute for the Future, in California, stresses that companies enabling not just generation but also distribution and transmission will shape the next energy era.

PwC adds that AI itself will help optimize energy usage across supply chains, automate sustainability compliance, and democratize carbon tracking—even among small suppliers. These tools could be critical as upcoming regulations in the EU impose stricter sustainability reporting requirements.

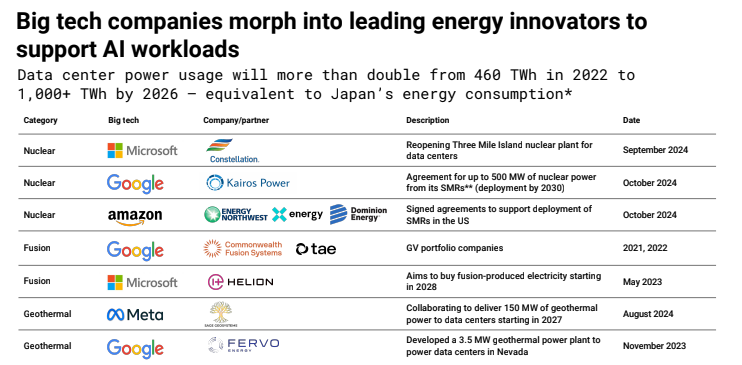

Source: CB Insights 2024 – Big Techs Turn Into Energy Innovators

Nuclear Resurgence and the Sustainability-Growth Dilemma

In 2025, nuclear is back in the spotlight. Although few executives identified Small Modular Reactors (SMRs) as a top sustainability technology in Capgemini’s global survey (October 2024), the narrative is changing quickly. SMRs are gaining momentum for their potential to provide scalable, carbon-free baseload power—a critical advantage as Big Tech seeks more control over energy inputs to fuel AI scale-ups. Unlike traditional nuclear plants, SMRs are designed to be faster to deploy, more flexible in size, and safer by design, helping to overcome long-standing concerns about cost, complexity, and risk. The shift is clear: as reported by Deloitte and Forbes, companies are now investing directly in SMR development, bypassing legacy energy systems.

This trend also reflects a deeper shift in business strategy. The challenge isn’t just generating enough energy—it’s balancing sustainability with scale. AI is both a burden and a solution: it drives up energy use but also enables the efficiencies and insight required to reduce carbon footprints. As PwC puts it, “AI makes not just carbon targets, but every sustainability goal more accessible.” Forward-looking companies are already using AI to model energy consumption, identify green vendors, and design lower-impact business models.