Super Apps

Key Takeaway:

Super apps are becoming increasingly popular as a one-stop shop for users to manage their daily lives. By 2027 more than 50% of the global population is expected to be using several super apps regularly, combining retail, finance or social features in an ever-growing array of services.

Trend Type: Social & Business

Sub-trends: Supper Apps Invasion, Retail Finance, Fintech Regeneration

Use Cases

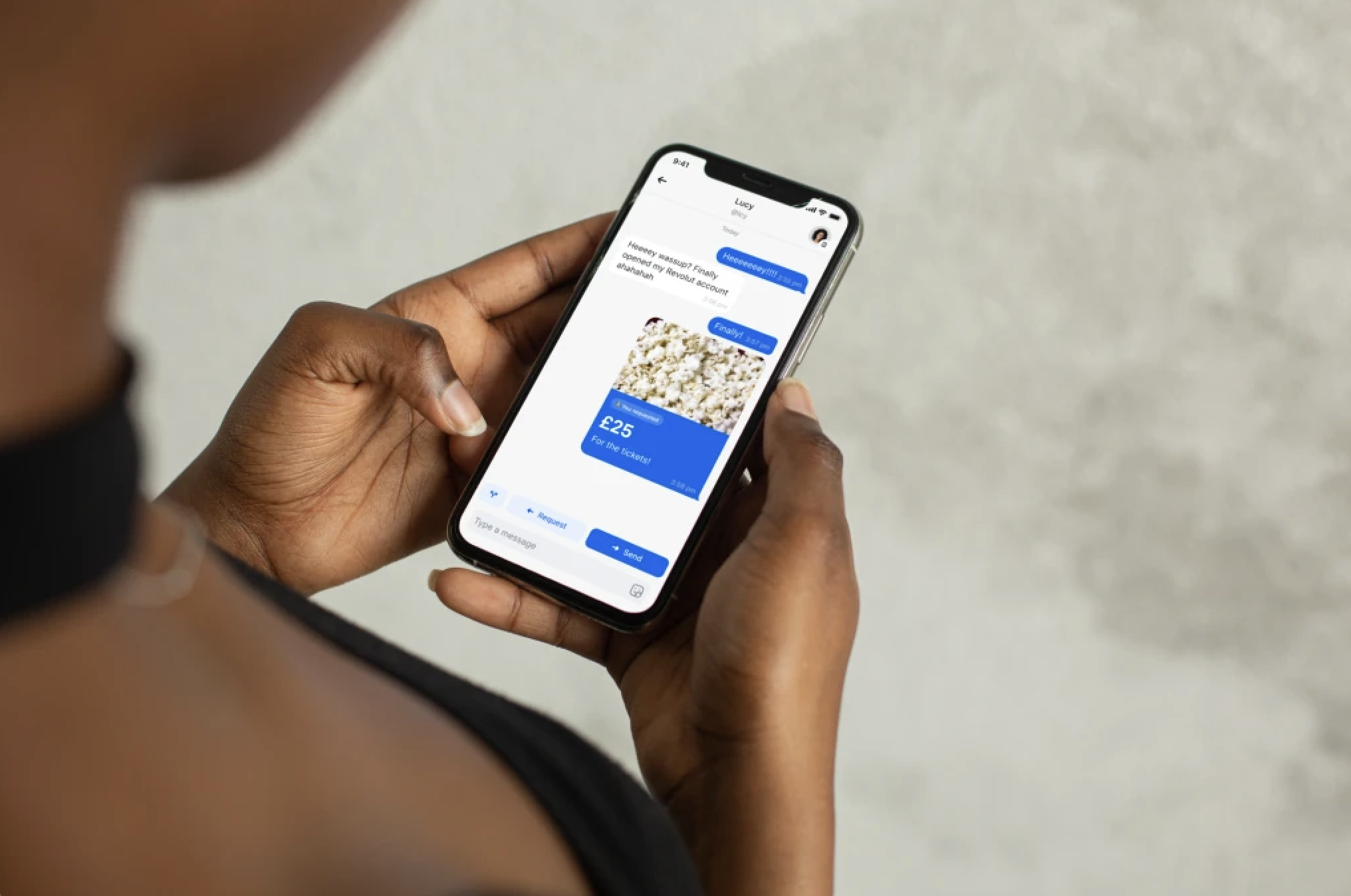

Fintech Regeneration: Revolut is a U.K.-based fintech superapp disrupting traditional financial services. It offers digital banking services for consumers and has expanded its ecosystem into businesses, where small and midsize businesses and freelancers can offer services in the superapp. It has just recently launched direct messaging for U.S., European and U.K. customers. While most of the top payments apps used in the U.S. and European continent support payment memos and payment requests, none offer a direct messaging feature like Revolut’s. By contrast, a growing number of messaging-focused apps including Apple Messages, Facebook Messenger and Signal allow users to send payments.”We’re delighted to bring instant messaging to our customers, moving us one step closer to being a global financial super

Fintech Regeneration: PayPay is a Japanese payment provider, with almost 50 million users. A key part of its growth strategy is to integrate the purchasing of third-party products and services within its superapp, and it already provides third-party miniapps for buying cinema tickets, ordering food deliveries and bicycle sharing, alongside its own apps for financial management services and retail shopping, among others.

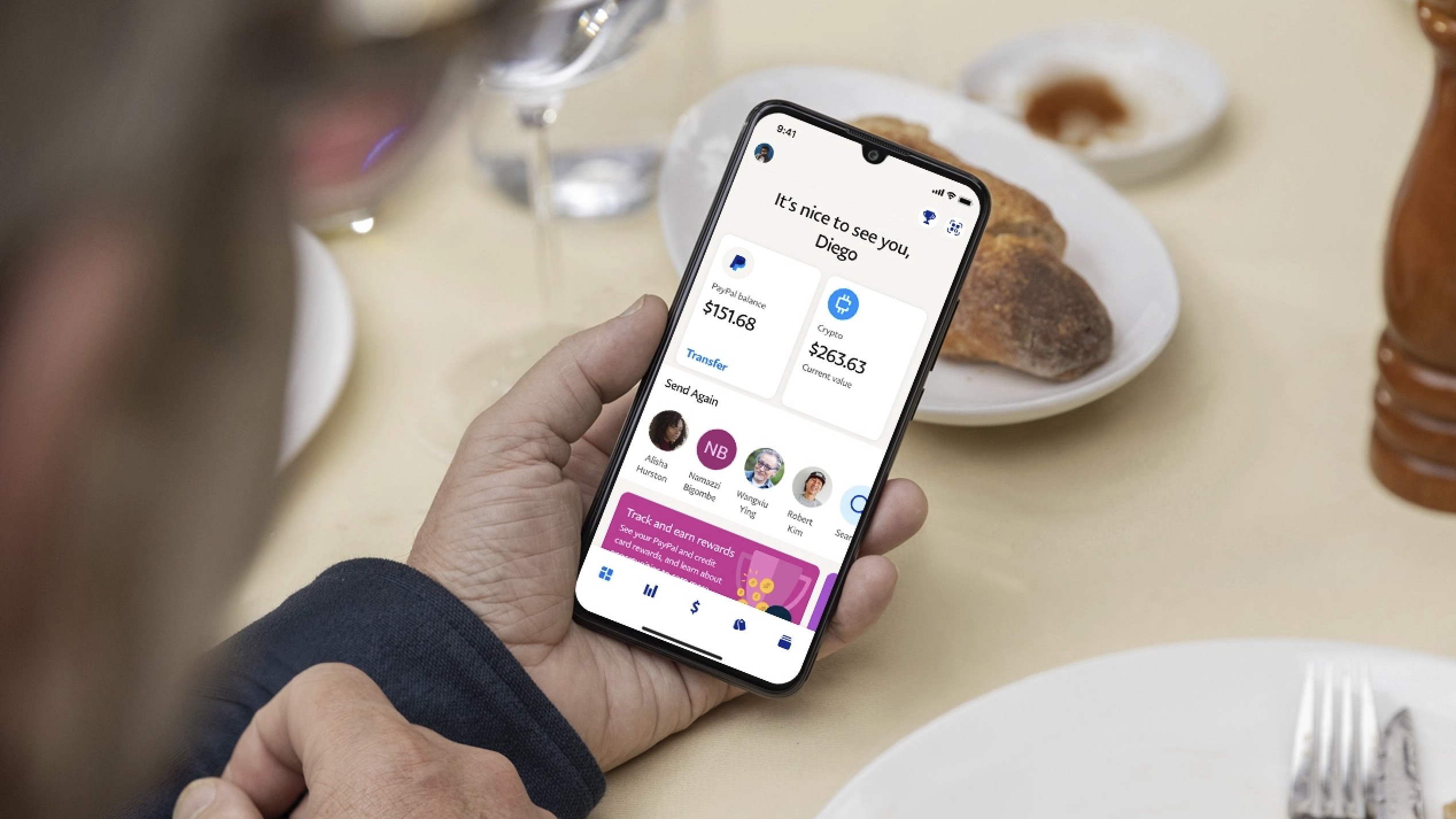

Fintech Regeneration: Paypal has officially launched a new version of its popular digital wallet and payments platform, which has been loosely dubbed the PayPal “super app.” A major update, the new app will combine a variety of financial tools offered by the company into one slick, user-friendly platform. These features include direct deposit, bill pay, peer-to-peer payments, digital wallet functionalities, shopping tools, crypto conversions, and more. As part of the new launch, PayPal has also teamed up with Synchrony Bank to release high-yield savings account aptly titled ‘PayPal Savings.’ These new updates represent an incredibly exciting development for the company as they allow PayPal to shift from a payments-only utility tool to a full-fledged finance app. In addition, the

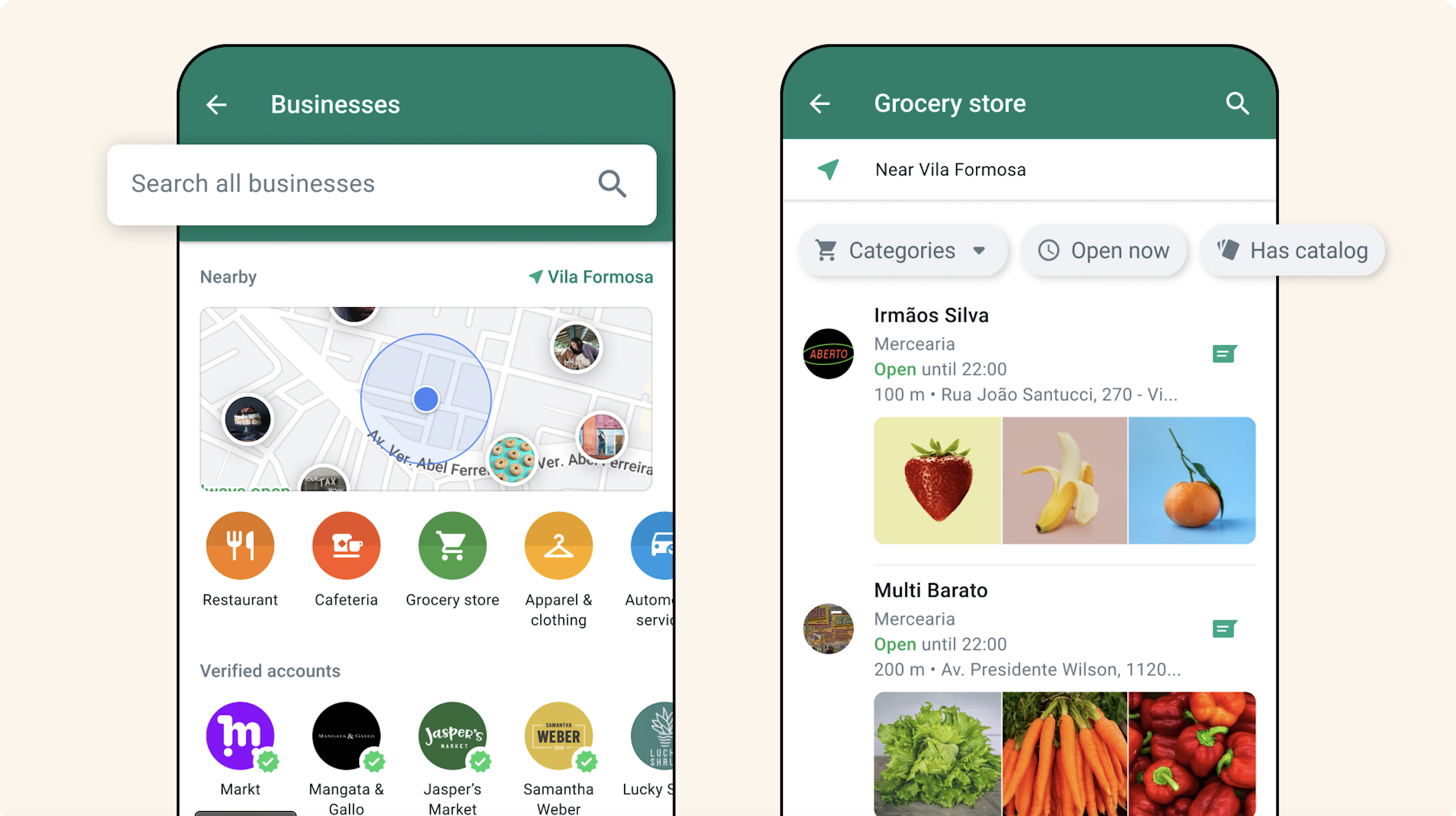

Super Apps Invasion: Meta’s super app goals may be clearest with WhatsApp, the messaging service it purchased in 2014. In November 2022, the company announced its “vision for bringing the entire shopping experience directly to a WhatsApp chat.” To start, WhatsApp users in certain countries (currently Colombia, Mexico, Indonesia and the UK) can now search for businesses within the app, message them directly, and make payments in the chat. Meta is charting a course to handle discovery, messaging, and payments for WhatsApp’s more than 2B users globally.

Super Apps Invasion: As explained by Archie Norman, Chairman of Marks & Spencer and a veteran of the retail sector, “The app already enables friction-free shopping on M&S.com, allows customers to spend and load best Sparks offers, provide Scan & Shop in M&S Food stores, and gives customers up-to-date recipe checks. Our objective is to double M&S app usage with a long-term goal of 10 million users. As a result of our growth, the app now accounts for around one-third of our Clothing & Home online sales. And while still small, Scan & Shop enables its use in store and food. To drive further growth, we’re working towards launching a single digital identity across all Marks & Spencer’s related

Retail Finance: Twig, a UK-based fintech company, has launched a mobile banking app that allows users to cash out on their used items instantly. Unlike other resale apps, Twig aims to be a full-fledged financial platform (not a retail site) that contributes to the circular economy. This free fintech app is easy to use and boasts a refreshingly simple UX design. All users have to do is upload photos of their “pre-loved” items, which are immediately analyzed by Twig’s machine learning algorithms and given a price tag. If users are pleased with the offer, they can cash out instantly, receiving a payment for their goods before any shipment is required. “Our mission is to empower consumers to unlock their