AI Chip Demand

Key Takeaway:

The semiconductor industry is on the brink of a transformative era, driven by the surging demand for generative AI chips, vertical integration of silicon, and GPU shortages. As companies navigate this complex landscape, balancing innovation, sustainability, and economic viability, the power of semiconductors will shape the future of technology and drive digital transformation across industries in 2024 and beyond.

Trend Type: Technology

Sub-trends: Semiconductors, GenAI Chip demand, Vertical Integration Into Silicon, GPU shortage forces companies to be smarter

Use Cases

Vertical Integration Into Silicon: Nvidia’s stock has skyrocketed over 500% in just 16 months. But what’s driving the meteoric rise of this tech giant, and are there storm clouds on the horizon? The meteoric rise of NVIDIA’s stock price is a clear signal of this sub-trend.

Cybersecurity: Netflix engineers developed Chaos Monkey, a novel way to ensure resiliency is being addressed. The software randomly terminates servers in production to ensure that en-gineers are architecting code in a way that would survive server failure.

Sub-Trend Sources

Semiconductors: Capgemini

GenAI Chip demand: Delloite TMT Prediction, Forrester Predictions, Trend Hunter

Vertical Integration Into Silicon: BCG The Next Wave, Forrester Predictions

GPU shortage forces companies to be smarter: CBInsights Emerging Tech Trends, Deloitte Tech Trends

What to Read Next

All Things Data

The increasing complexity and scale of data within modern enterprises lead into a shift in data management strategies, catalyzing a trend towards more dynamic, integrated, and technologically advanced approaches. This[...]

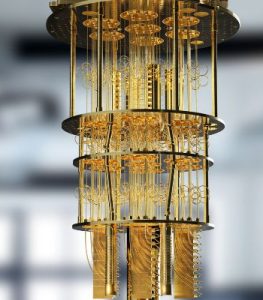

Quantum Computing

Latest Advances Although Quantum Computing was already present in last year’s Digital Trends, in 2024, the race to develop viable quantum systems is intensifying, with tech giants like IBM, Google,[...]

Eco Tech

The “Eco Tech” trend reflects the growing integration of technology with environmental sustainability efforts. Among the forefront technologies is carbon capture. Industries such as cement and steel are increasingly adopting[...]

What to Read Next

All Things Data

The increasing complexity and scale of data within modern enterprises lead into a shift in data management strategies, catalyzing a trend towards more dynamic, integrated,[...]

Quantum Computing

Latest Advances Although Quantum Computing was already present in last year’s Digital Trends, in 2024, the race to develop viable quantum systems is intensifying, with[...]

Eco Tech

The “Eco Tech” trend reflects the growing integration of technology with environmental sustainability efforts. Among the forefront technologies is carbon capture. Industries such as cement[...]