Metaverse

Key Takeaway:

Although some influential brands in distinct industries are leading the experiments in the Metaverse, and some use cases are inspirational, the mainstream digital user metaverse still needs to catch up to its promise. In 2023 it is expected some trough of disillusionment if the slope of enlightenment is to pick up later on and reach the projected 4 trillion USD by 2030, mainly in gaming and e-commerce.

Trend Type: Technology

Sub-trends: Metaverse Education, Metaverse Support, Metaverse Falls Short, Branded Games, Digital Identities

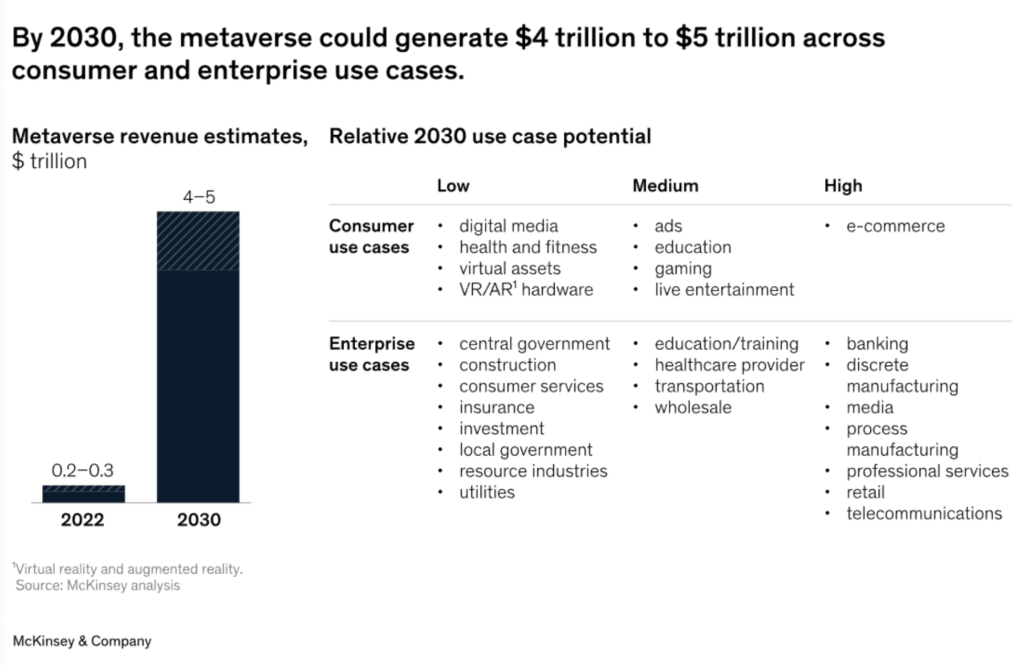

Metaverse is a combinatorial innovation made up of multiple technology themes and trends. Individually, these trends are projected to provide new opportunities, and challenges, to organizations across a broad spectrum of industries and use cases. Last year was powered by big moves (such as Microsoft’s $69 billion acquisition of Activision Blizzard, now under antitrust review) and small ones (about $12 billion to $14 billion of venture capital and private equity investment). According to Gartner, by 2027, over 40% of large organizations worldwide will use a combination of Web3, spatial computing, and digital twins in metaverse-based projects to increase revenue. Bloomberg states that the metaverse market is expected to reach $783 billion in 2024, up from $479 billion in 2020, and Mckinsey projects between $4 trillion to $5 trillion by 2030 across consumer and enterprise use cases. Statista suggests that 15% of the digital economy has already shifted to the Metaverse, and its reach is projected to be 700 million people worldwide by the end of the decade – stating that metaverse e-commerce sales alone could grow to more than $200 billion by 2030 from currently just around $20 billion.

Metaverse Revenue Estimates – Relative 2030 use case potential, McKinsey & Co 2023

Use Cases

Branded Games: Volkswagen South Africa launched an integrated Metaverse campaign through an NFT treasure hunt dubbed Game On. The hunt brings interactive storytelling to life as it introduces the world to the company’s latest safety and intelligence features in the IQ.DRIVE Polo model. The player to first uncover the secret NFTs will be rewarded with a selection of real and virtual prizes, including a PS5 and tuition offered by the Volkswagen Advanced Driving Academy. Volkswagen successfully blends the online gaming world with reality through this unique NFT offering. The game includes 100 NFTs dubbed the Mzansiverse. Since the game is localized in the South African market, players will travel through the recognizable Johannesburg streets throughout the game as they

Branded Games: Chipotle Mexican Grill has partnered with virtual reality gaming platform Roblox to launch the Chipotle Burrito Builder, a new simulation experience that invites Roblox players to roll their own burritos in the metaverse. Through the unique experience, players will be able to earn Burrito Bucks, which can be exchanged for an entrée code that can be cashed on the Chiptole app. The Chipotle Burrito Builder marks the first time a brand has used Roblox to offer in-game currency that can be exchanged for real-world products, making it a phygital experience that is certainly worth taking note of, especially for other brands looking to innovate in this space. “We’ve tapped into play-to-earn, an emerging engagement model in the

Metaverse: JPMorgan Chase, the U.S. investment bank, bets metaverse is a $1 trillion per year opportunity as it became the first bank to open in Decentraland — one of the world’s most popular metaverse platforms.

Metaverse Education: French tech startup Mainbot launched ‘Winkyverse‘ the first-ever global educational games metaverse dedicated to teaching children and their families about emerging technologies, powered by its own digital currency, The Winkies. The WinkyVerse is the first educational ecosystem who manages to combine no less than six of the most promising technologies: Robotics, Artificial Intelligence, Programming, Gaming, Augmented Reality and Blockchain. The WinkyVerse is divided in three distinct spaces where families from all over the world will go to Learn, Create, Play and Connect.

Metaverse Customer Support: ‘TMRW’ crowns itself as the first entity to launch a medical customer support center in the metaverse. The TMRW platform allows patients to simply open the MOHAP’s website and click a button to launch a 3D, simulated reality office that resembles a real-world medical office. In this metaverse application, patients will be able to handle account-based information such as medical card renewal and payment processing, as well as minor medical appointments such as regular check-ups, diagnostic appointments for non-emergency symptoms, and more. The TMRW platform is expected to save citizens both time and money as it eliminates the need to travel to a physical clinic for countless services.