Space Race

Key Takeaway:

The new space race is reshaping global infrastructure, not just exploration. Space launches have surged 5x in five years, led by SpaceX’s dominance in satellite deployment and reusable rockets. With satellite constellations expanding and cislunar ambitions rising, space is becoming an extension of Earth’s economy. Investment is flowing into startups building orbital services and lunar capabilities, but risks around regulation, commercial viability, and geopolitics remain high. In 2025, mastery of low-cost access, infrastructure, and space resources will define leadership in the next economic frontier.

Trend Type: Technology

Sub-trends: Space Race

Space Access and Emerging Infrastructure

The new space race isn’t just between countries — it’s between companies. Over the last five years, the number of space launches has increased fivefold, largely fueled by SpaceX’s dominance (Economist Tech Trends 2025). SpaceX, valued at $350 billion as of December 2024, holds seven times the number of licensed launches as its next competitors. Thanks to innovations like reusable rockets, the cost to reach orbit has fallen by a factor of eight since 2008. SpaceX’s Starship, already undergoing multiple test flights, aims to lower costs even further, targeting just $500 per kilogram of payload sent into orbit.

This surge is reshaping satellite deployment. In 2023 alone, SpaceX’s Starlink constellation accounted for 1,935 of the 2,646 objects launched globally — roughly 73% of all launches (Economist Tech Trends 2025). Starlink, SpaceX’s satellite internet project, is building a massive constellation of low-Earth orbit satellites designed to deliver high-speed internet globally, particularly in remote and underserved regions. With 6,200 LEO satellites already in service, Starlink dominates the commercial satellite market. Europe’s Eutelsat OneWeb follows distantly with over 600 satellites, and Amazon’s Project Kuiper is expected to enter the fray in 2025.

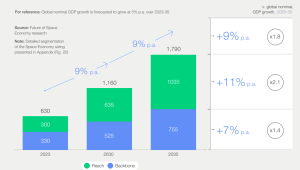

Meanwhile, an analysis from the World Economic Forum (2024) highlights that satellite services — including connectivity, Earth observation, and navigation — will be the primary drivers of space economy growth through 2035. Their projections show space economy revenues could nearly triple to over $1.8 trillion by 2035, driven mainly by commercial demand. In WEF’s framework, “backbone” refers to core infrastructure such as launch services and orbital platforms, while “reach” refers to commercial services delivered to Earth, like communications and geospatial analytics.

Source: WEF: Space Economy Size (2023-2035)

Lower launch costs are spawning a new generation of startups in satellite tech, advanced propulsion systems, and geospatial services. Satellite proliferation is expanding applications across national defense, industrial mapping, maritime logistics, and environmental monitoring. Yet, while satellite internet availability will expand in 2025 — with countries like Saudi Arabia, South Korea, and Japan announcing multi-billion-dollar investments — consumer adoption will remain low. High costs and strong terrestrial telecom networks will confine satellite internet primarily to enterprise sectors. At the same time, governments are closely monitoring developments, with rising concerns about reliance on foreign-owned communications infrastructure.

Building the Off-Earth Economy

As launch services mature, the privatization of space is extending beyond deployment to operations. According to the Future Today Institute’s 2025 outlook, private enterprise is beginning to colonize cislunar space — the region between Earth and the Moon — setting the stage for a new economic frontier.

This next phase includes the development of orbital manufacturing facilities, in-space refueling stations, and maintenance hubs. Together, these components form the backbone of what will become a sustainable space economy. Companies able to refuel satellites or service spacecraft in orbit will dramatically improve the long-term viability of missions.

Key resources are also driving this expansion. The discovery of water ice on the Moon and rare minerals has intensified interest in lunar exploration. Zero-gravity manufacturing capabilities offer industries like pharmaceuticals and semiconductors a chance to access production environments unavailable on Earth.

Investment signals are strong. Leading accelerators such as Y Combinator, Techstars Space Accelerator, and Seraphim Space Camp are nurturing startups in satellite services, propulsion technologies, and orbital logistics. Areas attracting the most attention include geospatial analytics for defense and agriculture, orbital logistics like on-orbit refueling and debris removal, and lunar mining.

Yet, the rush brings risks. The Economist warns that the commercial viability of satellite internet remains uncertain. Fierce competition from terrestrial networks could limit revenue, while regulatory gaps in orbital traffic management and resource rights persist.

In addition, geopolitical tensions are rising. NATO designated space as an operational domain in 2024, the EU launched the IRIS2 sovereign satellite constellation project, and the US Space Force emphasized defending commercial satellite infrastructure in its 2025 doctrine. Warnings from the World Economic Forum highlight that rising orbital congestion could dramatically increase collision risks by 2030.

Use Cases

Space Race: Space companies rely upon connectivity to run their business but ground infrastructure is stuck in the past. Northwood is a space startup that wants to build ground stations which can talk to satellites, and can be scaled fast – in a matter of days. It all began with a question: what would the future of satellite backhaul look like if built from the ground up?

Space Race: The US might be dominating space, but on solid ground, China is making gains in the race. In this new space era, no superpower can afford to fall behind, with 60,000 satellites soon to be in orbit. They are essential to our lives and could determine who wins or loses a war.

Use Cases

Sub-Trend Sources

Space Race: CB Insights Tech Trends, Economist Tech Trends, Future Today Institute

What to Read Next

Embodied AI

Embodied AI and Robotics The integration of foundation models into robotics is revolutionizing how machines interact with the world, enabling them to reason, adapt, and operate autonomously in dynamic environments.[...]

Flexible AI

The Rise of Specialized AI Models As organizations adopt hybrid models to balance flexibility and control, they are also rethinking how AI is deployed across environments. While foundational models built[...]

Scientific AI

AI Meets Scientific Discovery A new frontier is opening where AI is not merely a support tool for scientific research—it’s becoming a catalyst for fundamental breakthroughs. This shift was symbolically[...]

What to Read Next

Embodied AI

Embodied AI and Robotics The integration of foundation models into robotics is revolutionizing how machines interact with the world, enabling them to reason, adapt, and[...]

Flexible AI

The Rise of Specialized AI Models As organizations adopt hybrid models to balance flexibility and control, they are also rethinking how AI is deployed across[...]

Scientific AI

AI Meets Scientific Discovery A new frontier is opening where AI is not merely a support tool for scientific research—it’s becoming a catalyst for fundamental[...]